Expedited Credit Repair Sweep

Fix Your Credit. The Right Way FAST!

The Expedited full Service

Credit Sweep

Aggressive 3-bureau credit sweep: We dispute with Experian, Equifax & TransUnion using metro 2, FCRA, and advanced legal tactics

We remove the negative, keep the good: Collections, charge offs, repos, lates, inquiries gone. Your credit age, limits, and history stay.

Hands-off, Done-For-You Process: No templates, no monthly fees just real execution by our team

Bonuses:

Funding Portal: A step-by-step course to help you start positioning for funding after your credit is clean

Community Calls: Access to our private Community Calls to get your questions answered and stay on track

If you’re tired of getting denied and ready to clean up your profile, this is where it starts. We don’t promise the moon — we promise real work.

LIMITED-TIME BONUS: EXCLUSIVE TO THIS OFFER

Exquisite money group VIP portal

(Regularly $1000 — Yours FREE Today with

Exquisite Credit Repair)

For the next 24 hours only, when you enroll with Exquisite Credit Repair, you’ll unlock free access to our powerful digital course: Exquisite Money Group VIP Portal.

⏳ When the timer hits zero, this exclusive bonus is gone for good.

Inside the Portal, you’ll discover how to strategically position yourself for real

funding once your credit profile is clean:

✅ In-depth Credit Bureau Breakdown

✅ Free credit repair hacks & funding strategies

✅ Build 750+ credit & unlock $100K–$500K in no-PG funding

✅ Learn credit-to-cash methods & 0% interest plays

✅ Access $2,500 no credit check tradelines

💼 Plus:

✅ Acquire businesses using OPM (Other People’s Money)

✅ Scale your business to 6–7 figures

✅ private access to our Weekly mentorship calls, q&a, support, and tools to earn $40K+/Month. plus learn exactly how to approach each credit bureau, which banks to target, what data points matter most, and how to structure your funding strategy to maximize approvals.

Real Guidance. Real Strategy. Real Results.

Only from Exquisite Credit Repair — where your financial future gets the upgrade it deserves.

This is a no-subscription, no-BS, hands-on service.

You pay once, and we do the work.

What Sets Us Apart from Other Credit Repair Companies

At Exquisite Credit Repair, we go beyond the basics. While most companies only dispute with the credit bureaus, we take a comprehensive four-angle approach to ensure maximum results.

We dispute directly with:

The Credit Bureaus

The Original Creditors

The Consumer Financial Protection Bureau (CFPB)

The Better Business Bureau (BBB)

This aggressive strategy gives your negative items nowhere to hide.

And if we run into any stubborn accounts? No problem. We have an attorney on our team ready to take legal action on your behalf. If the bureaus fail to comply, we’ll sue and work to get you compensated for each item they refuse to delete.

With Exquisite Credit Repair, you don’t just repair your credit you fight back

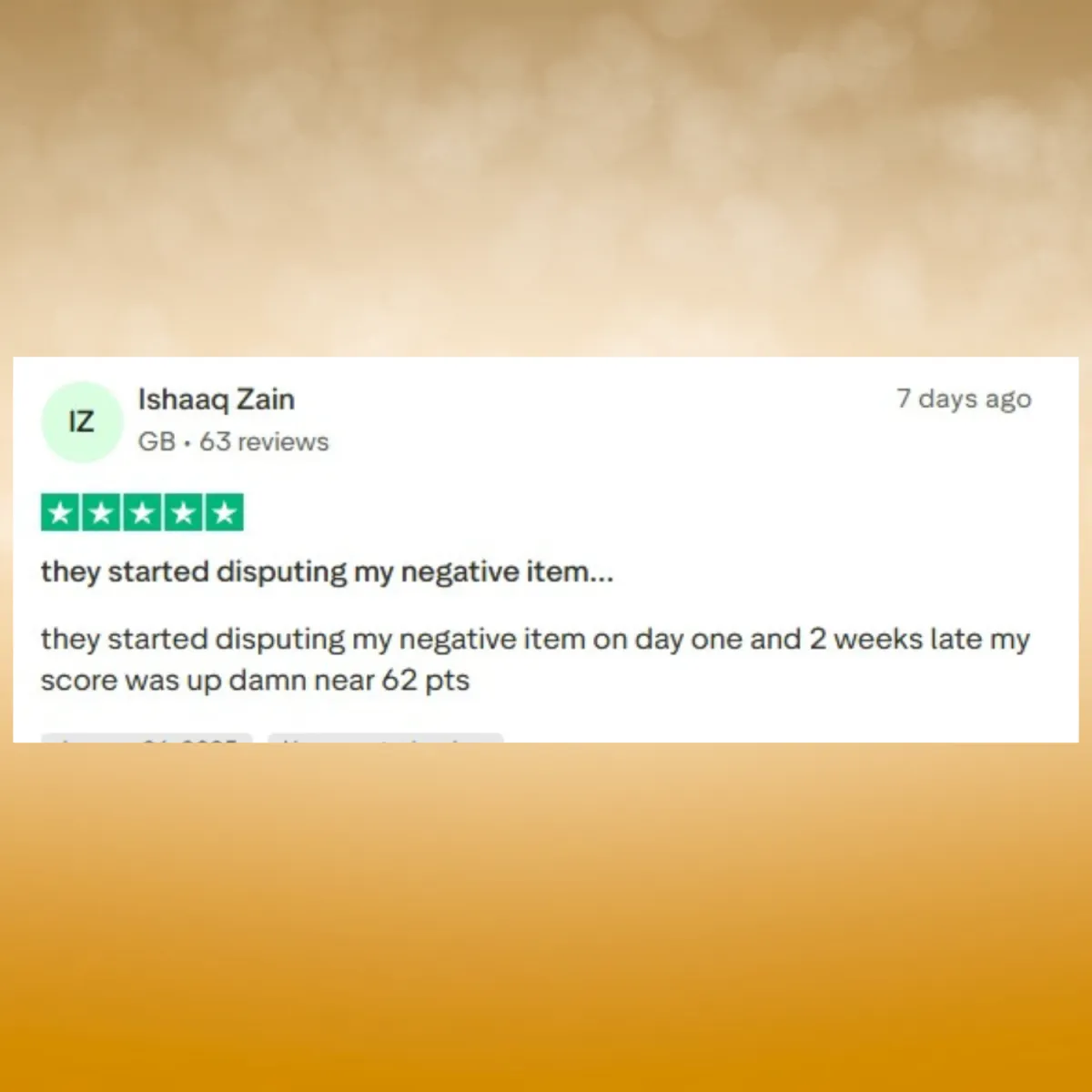

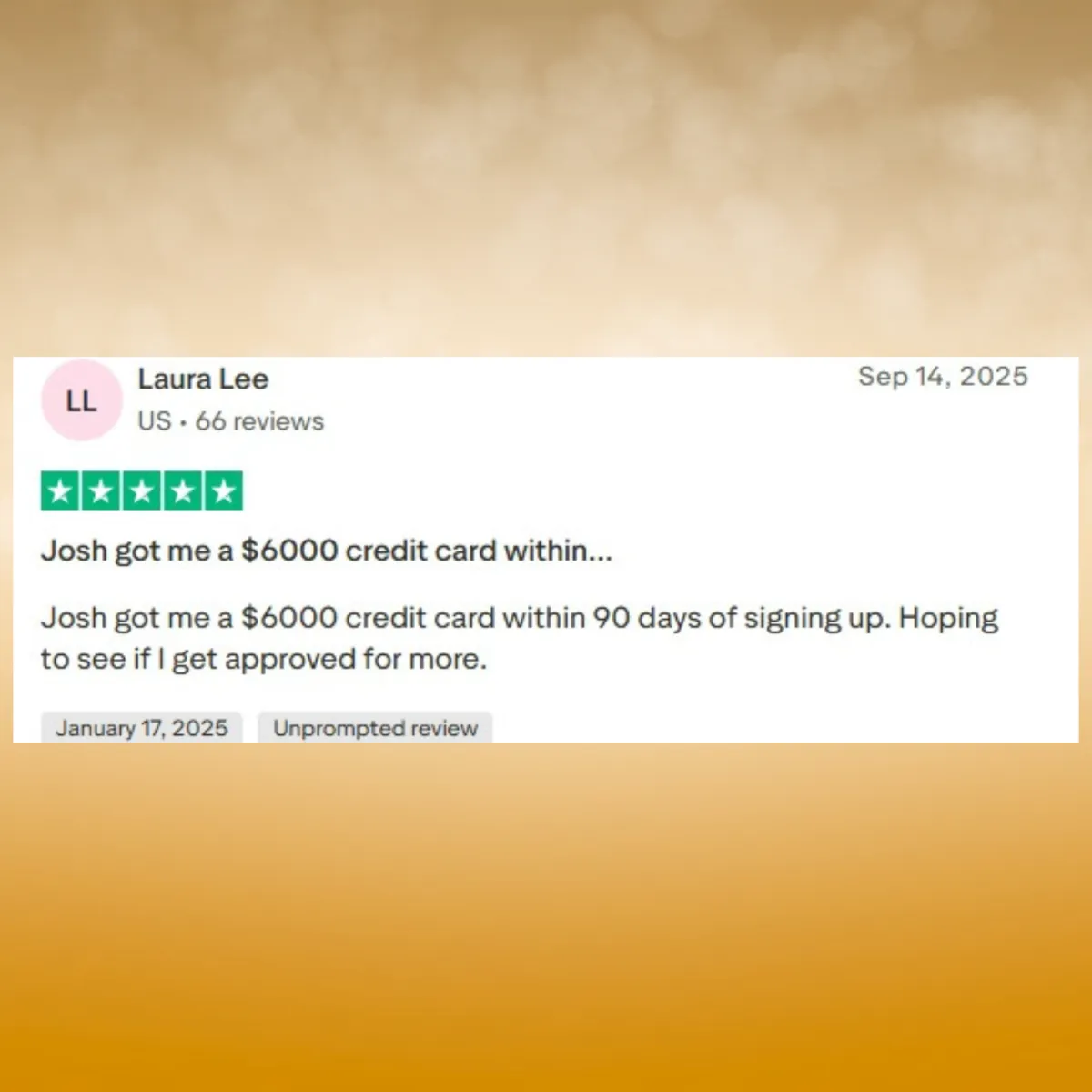

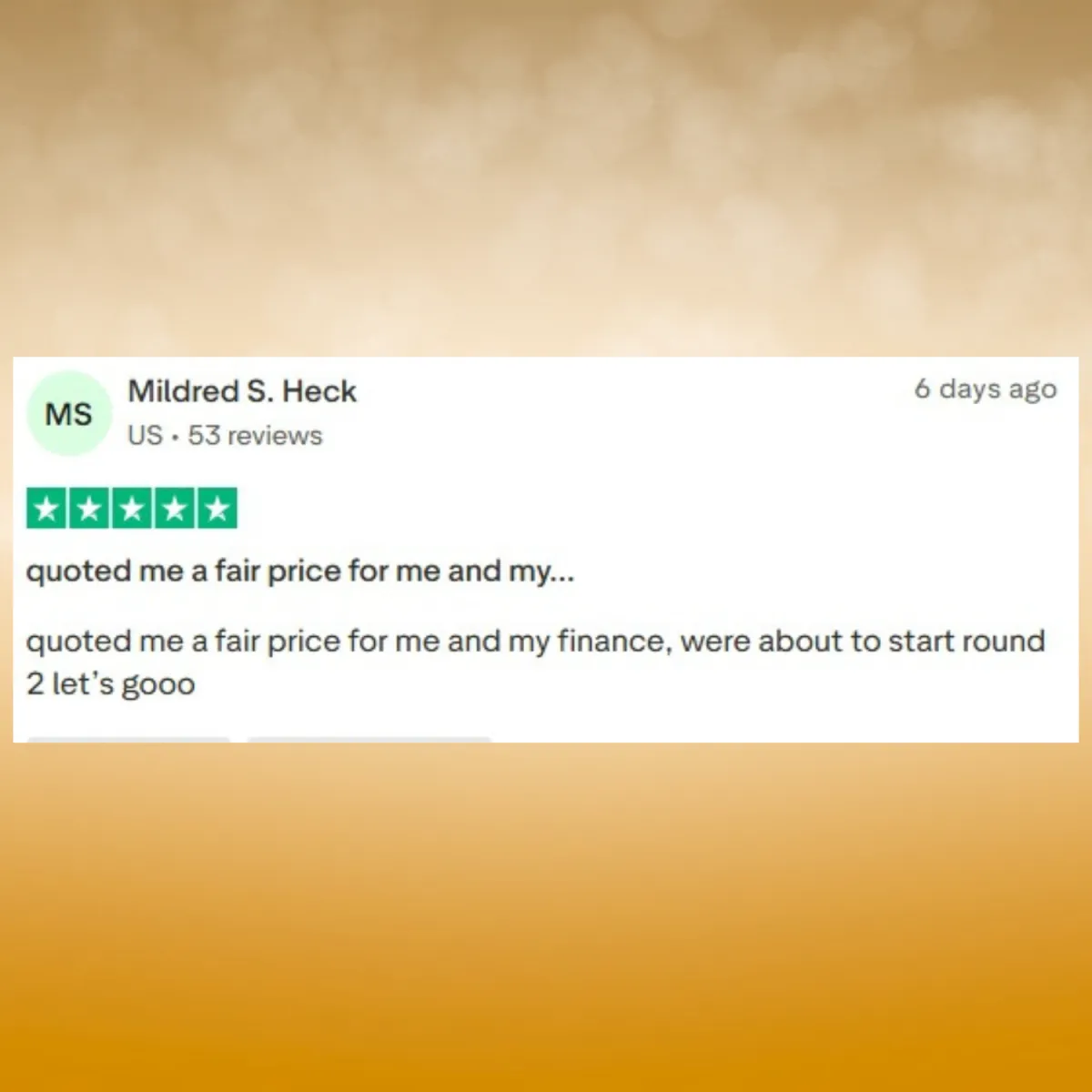

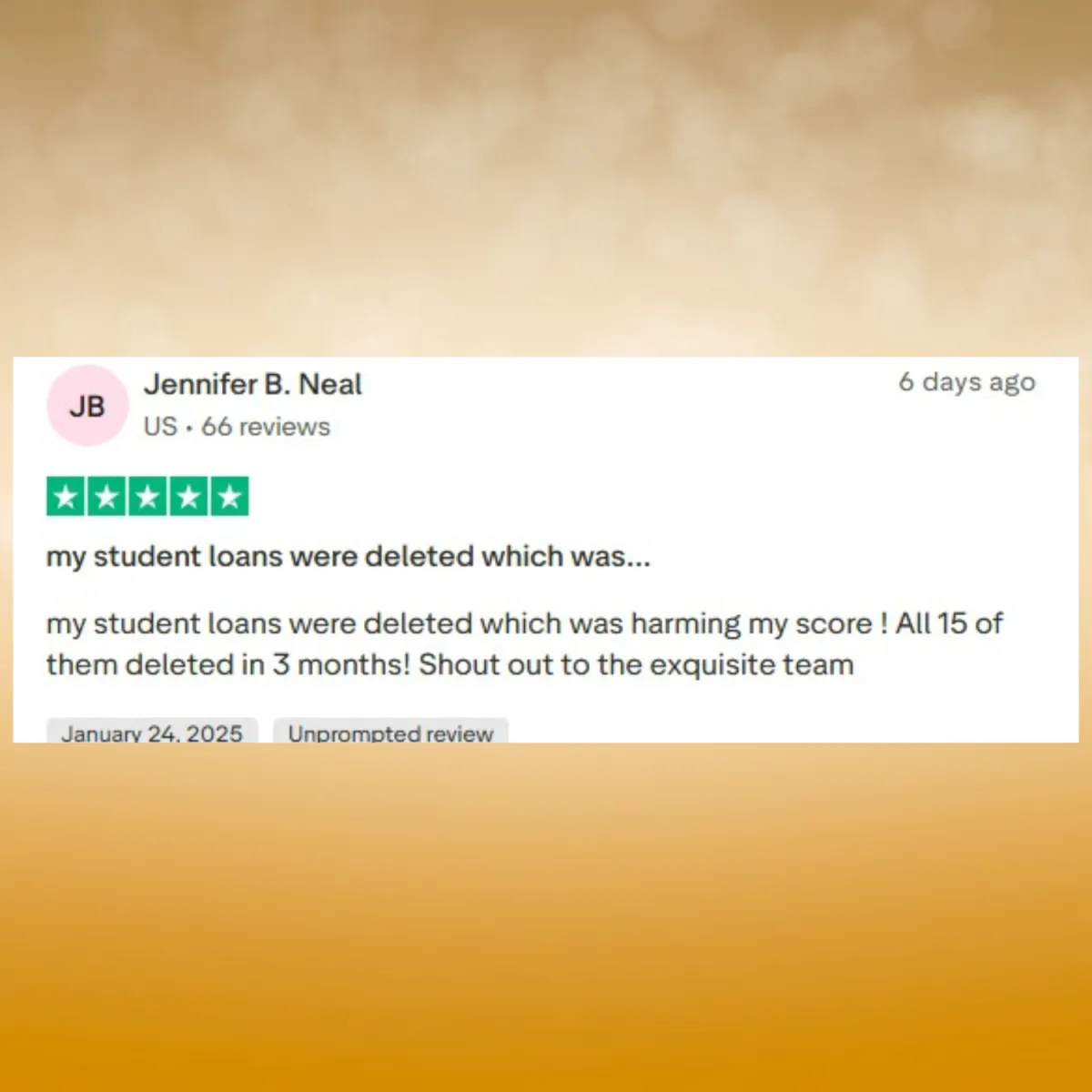

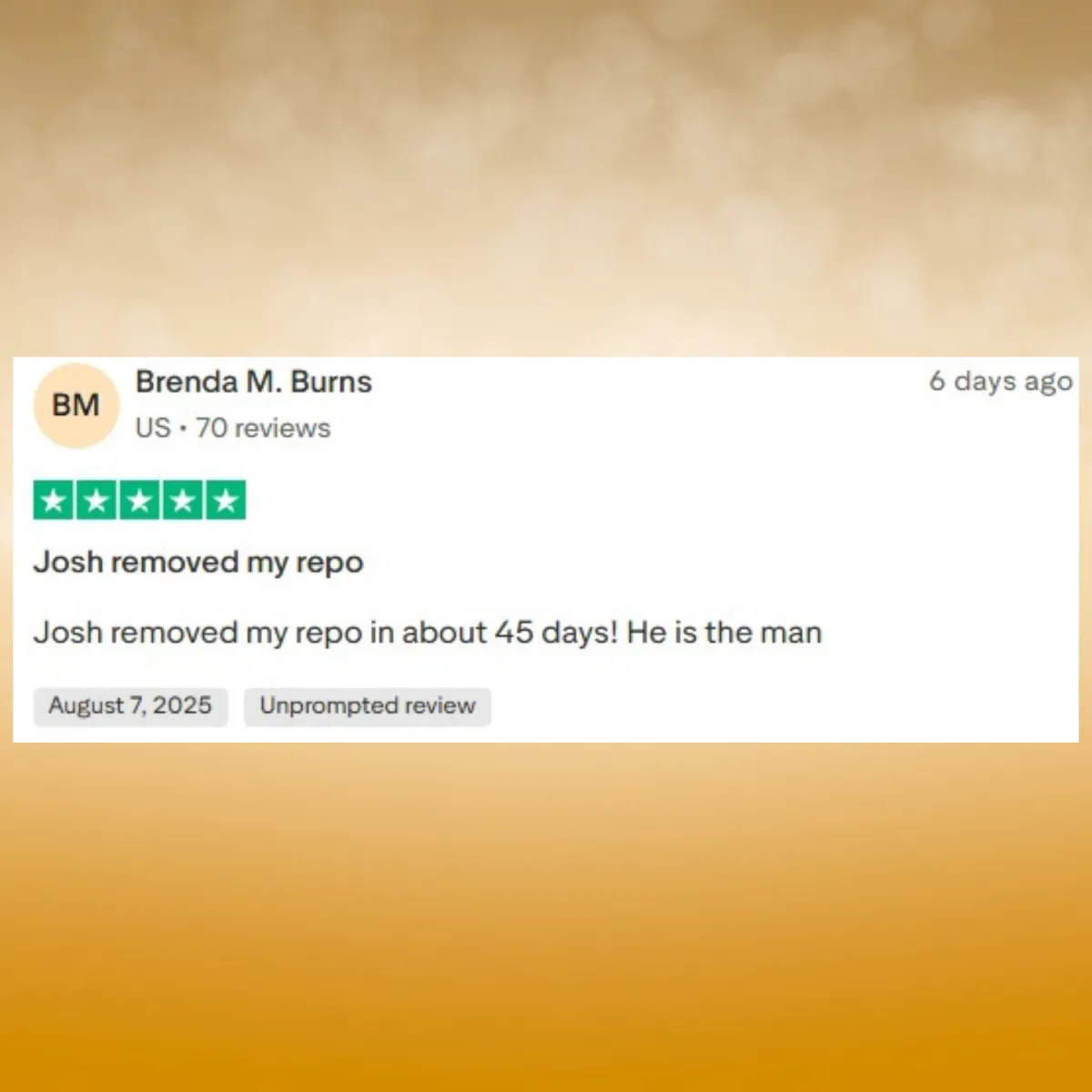

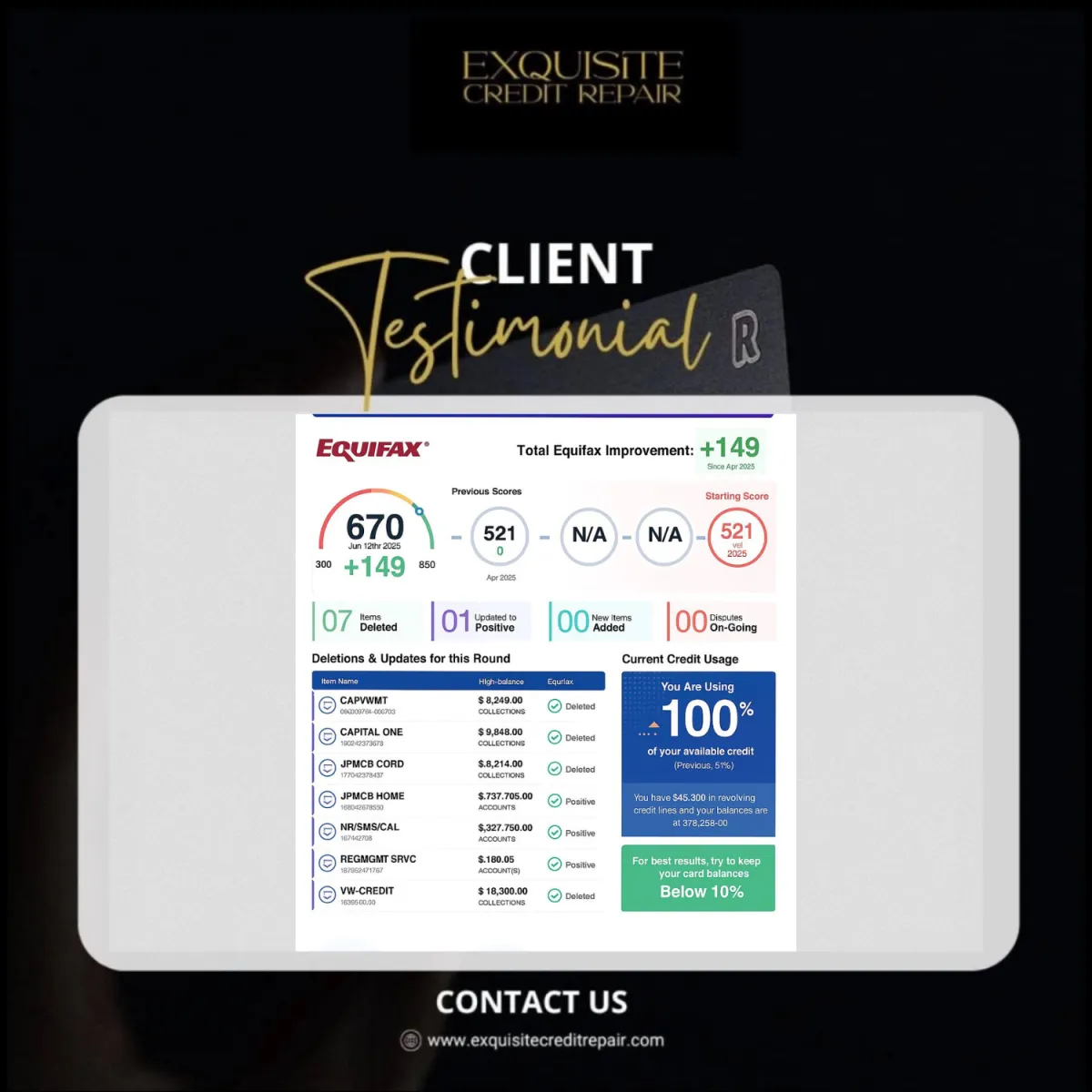

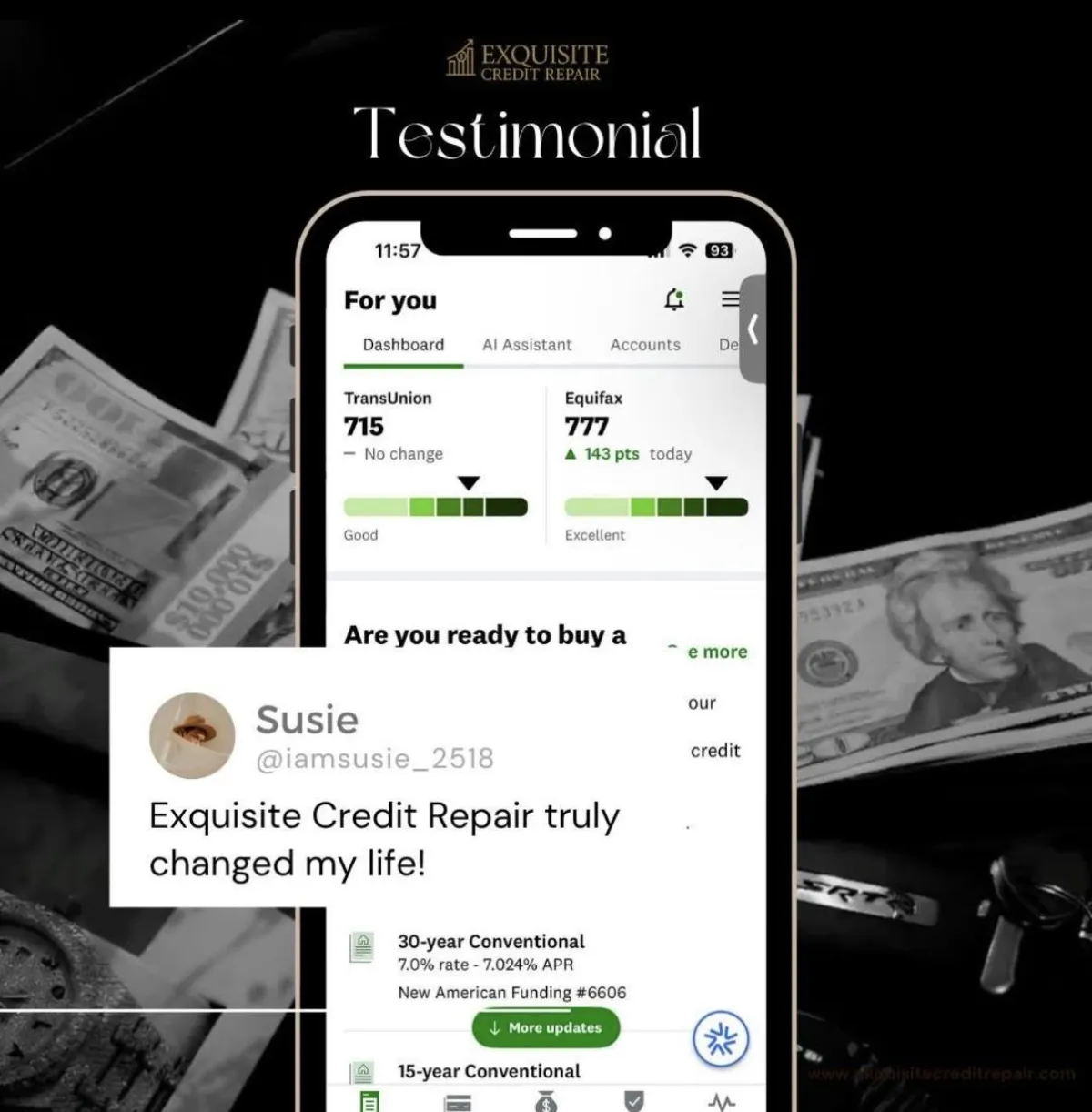

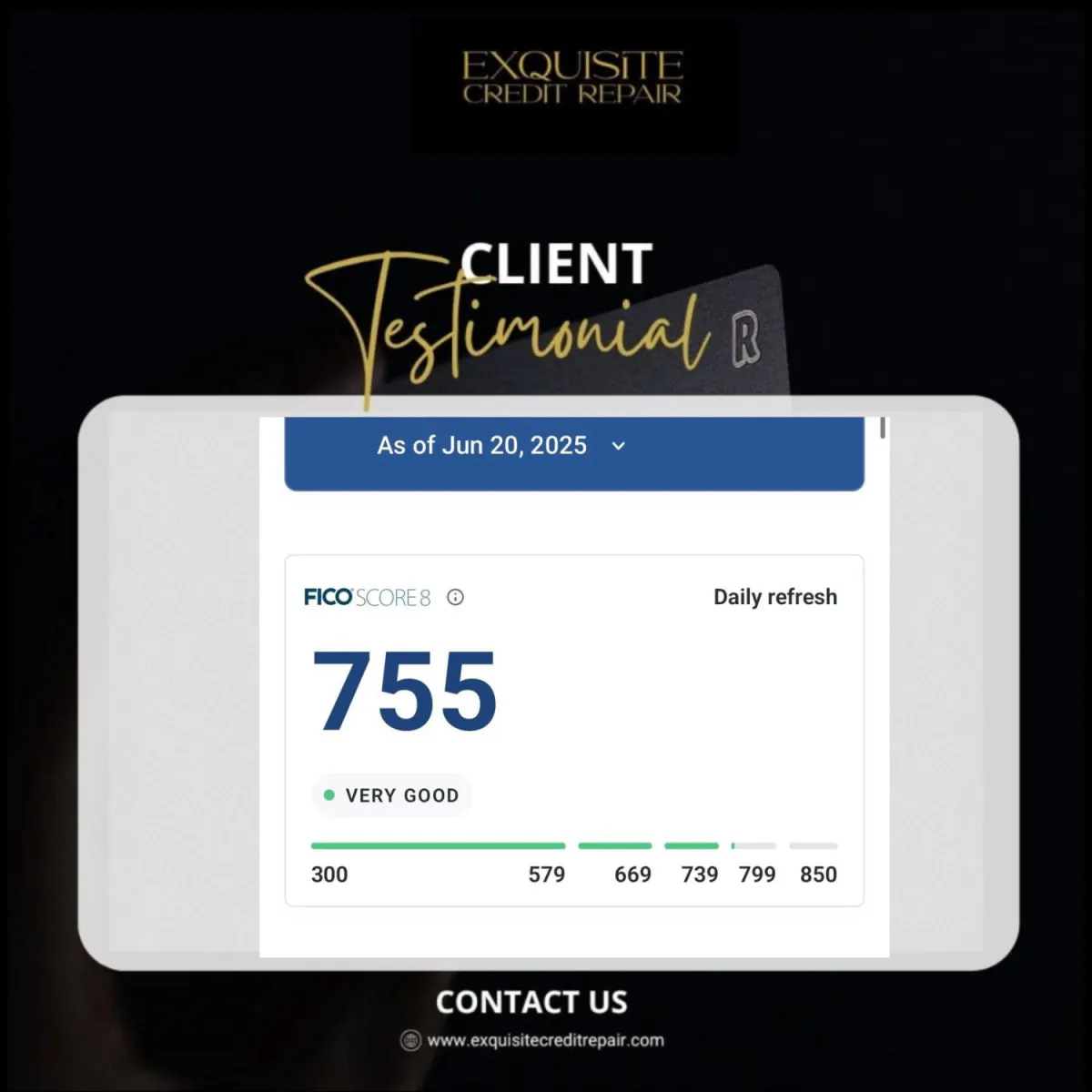

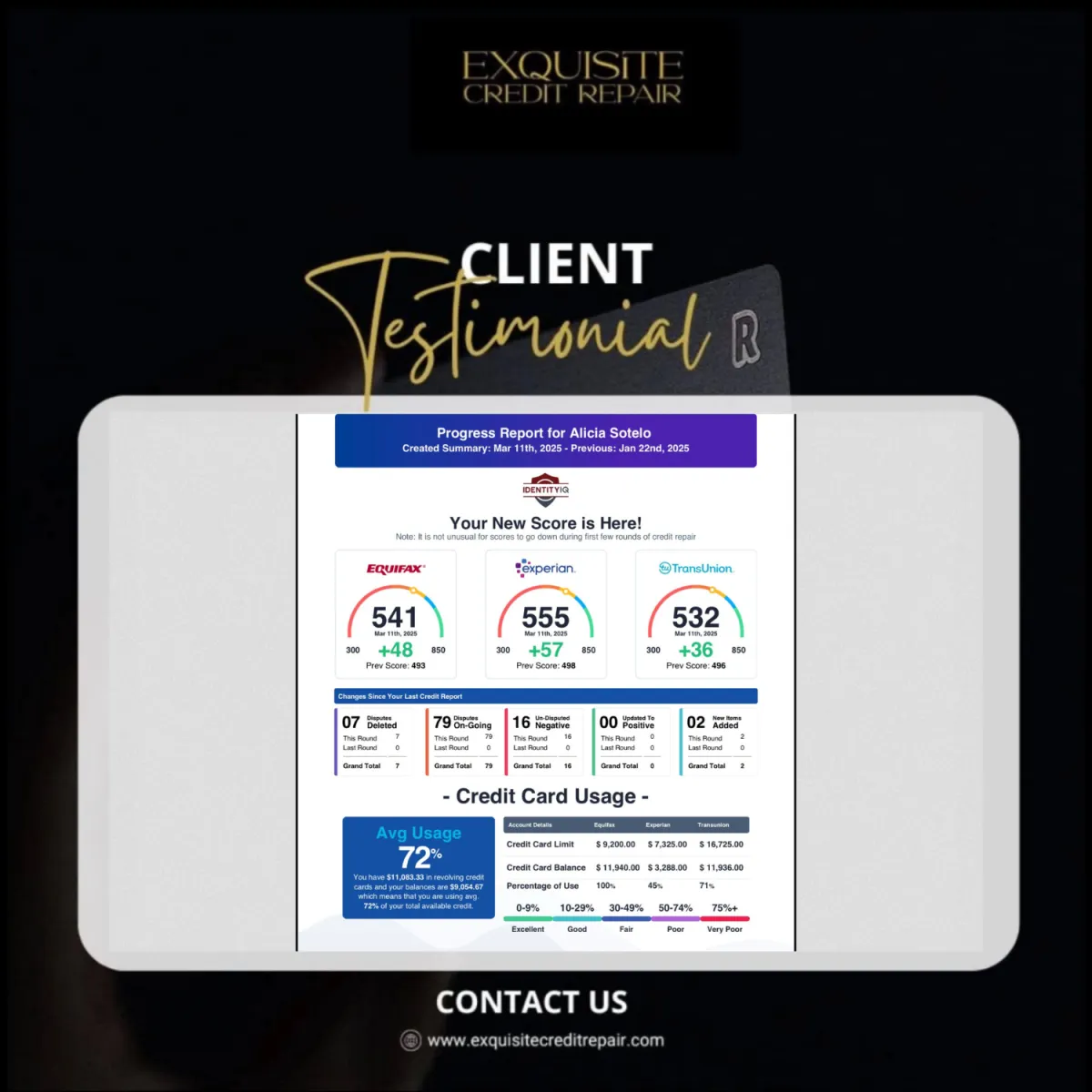

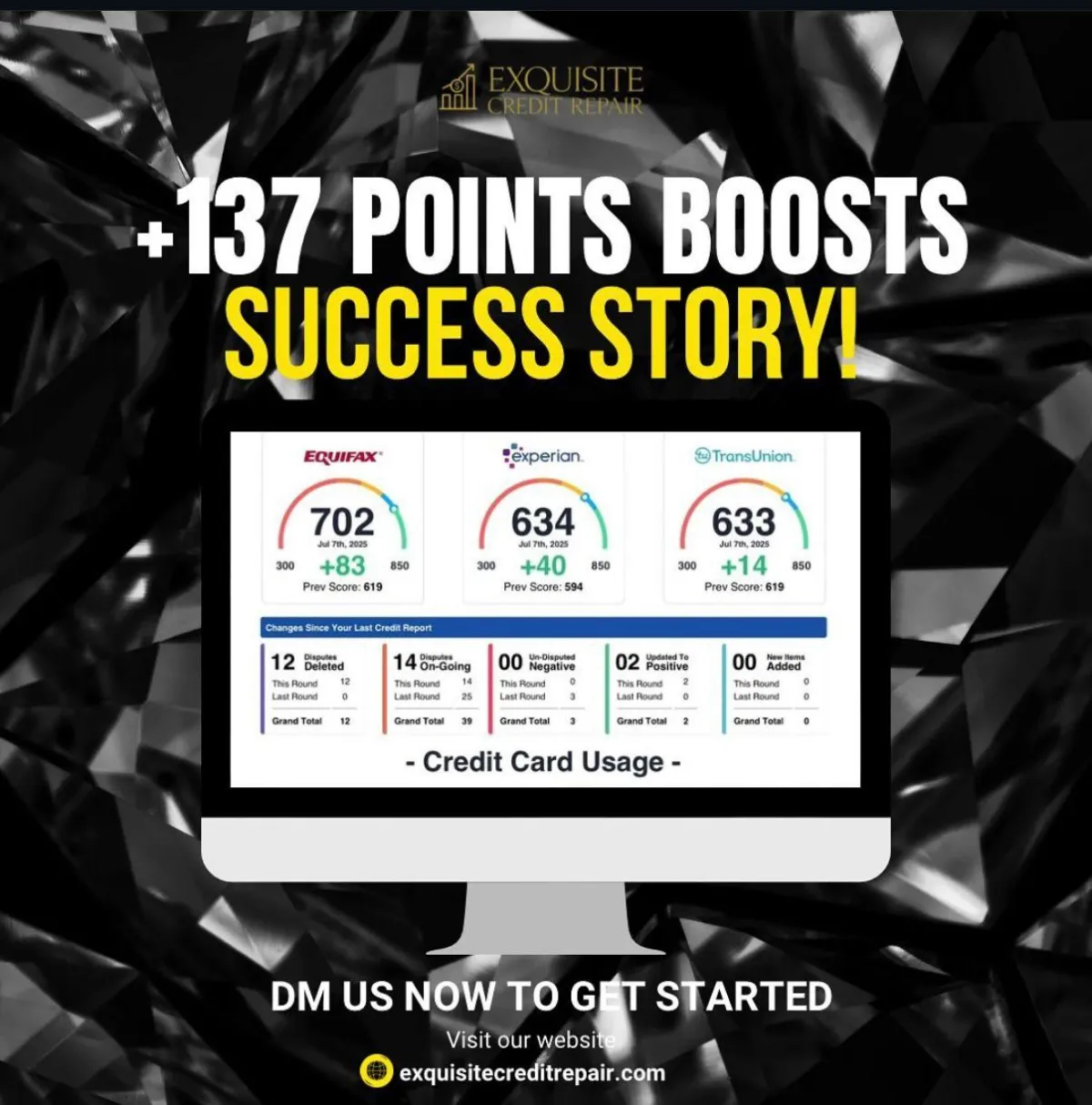

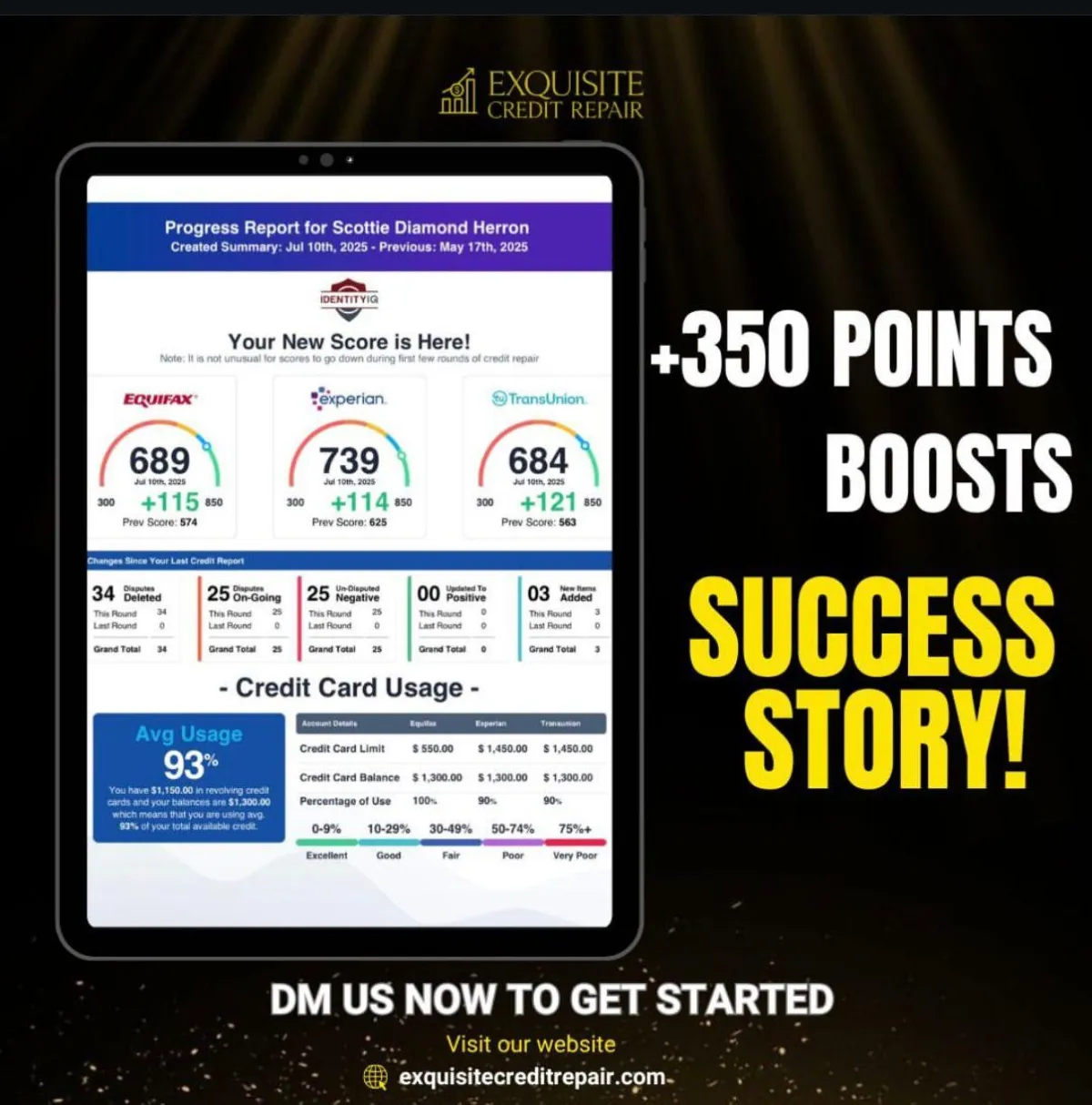

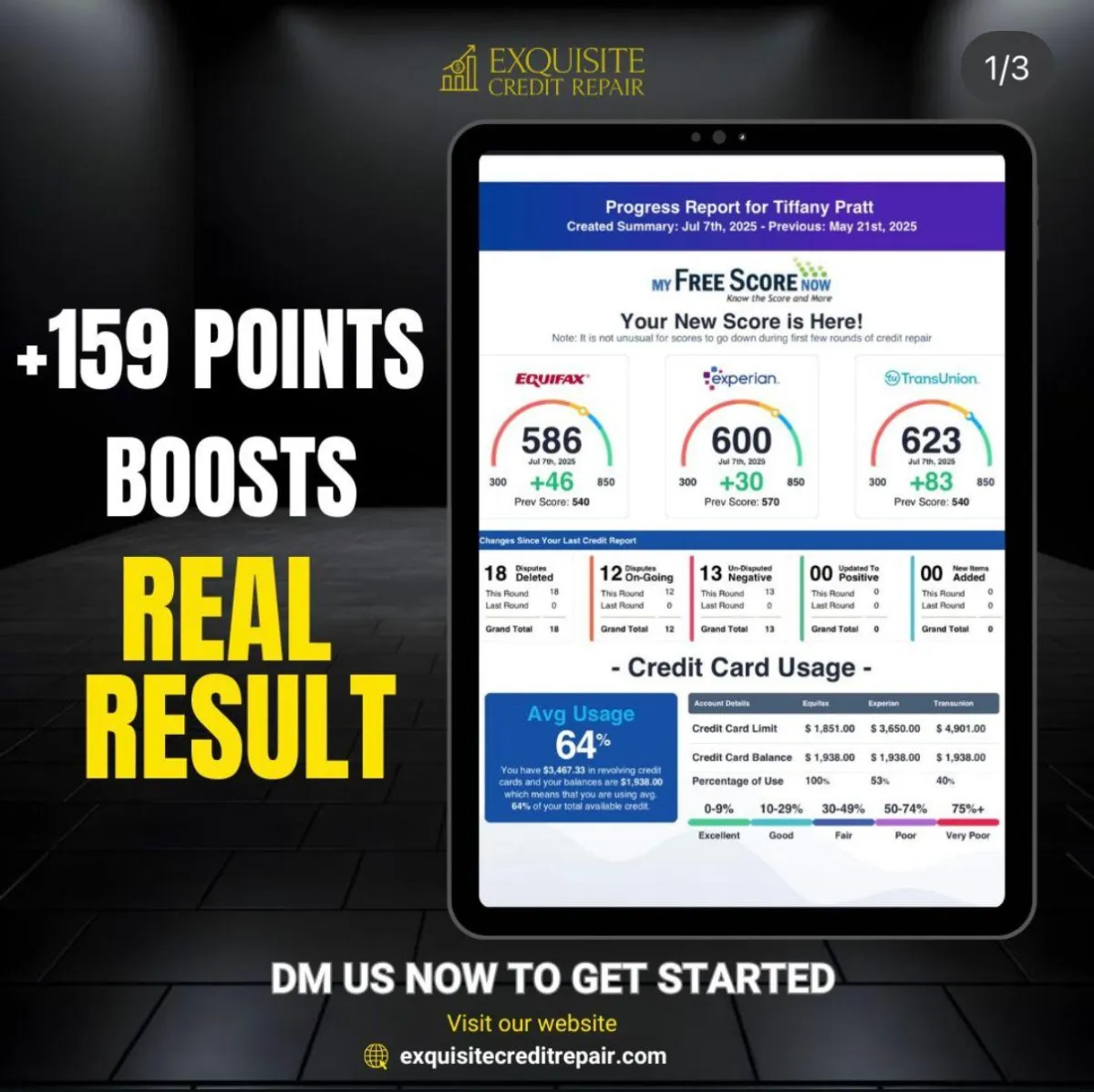

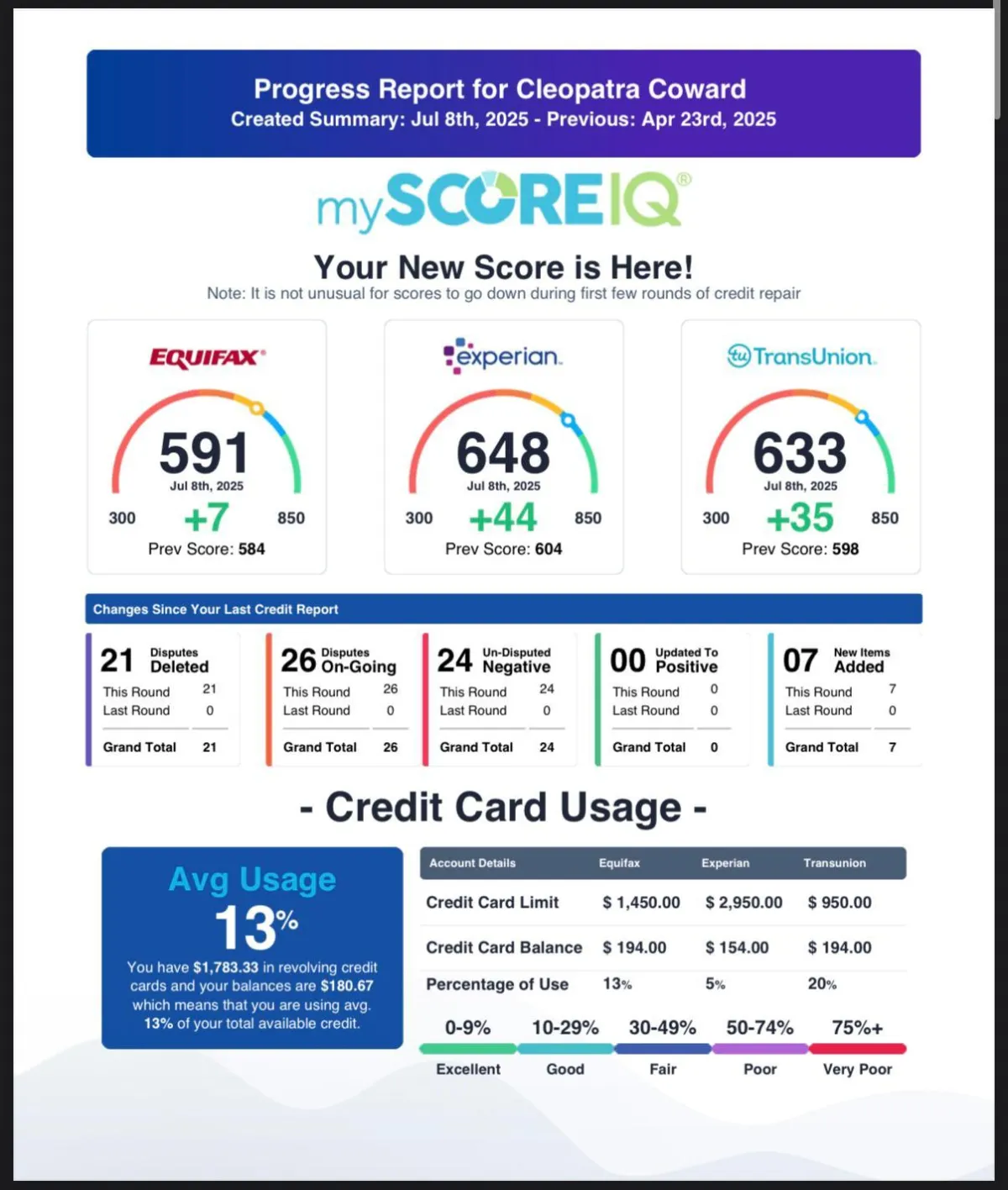

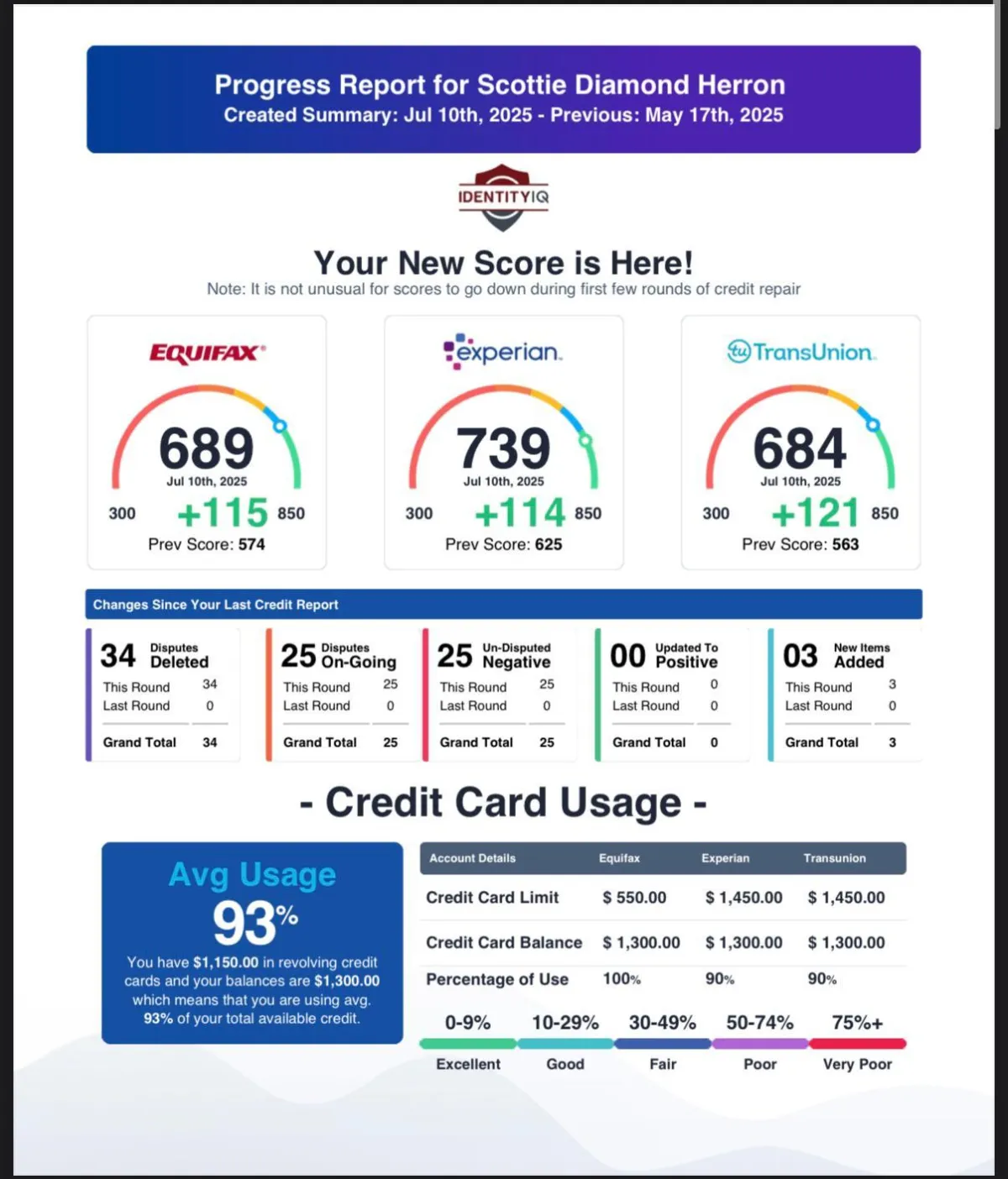

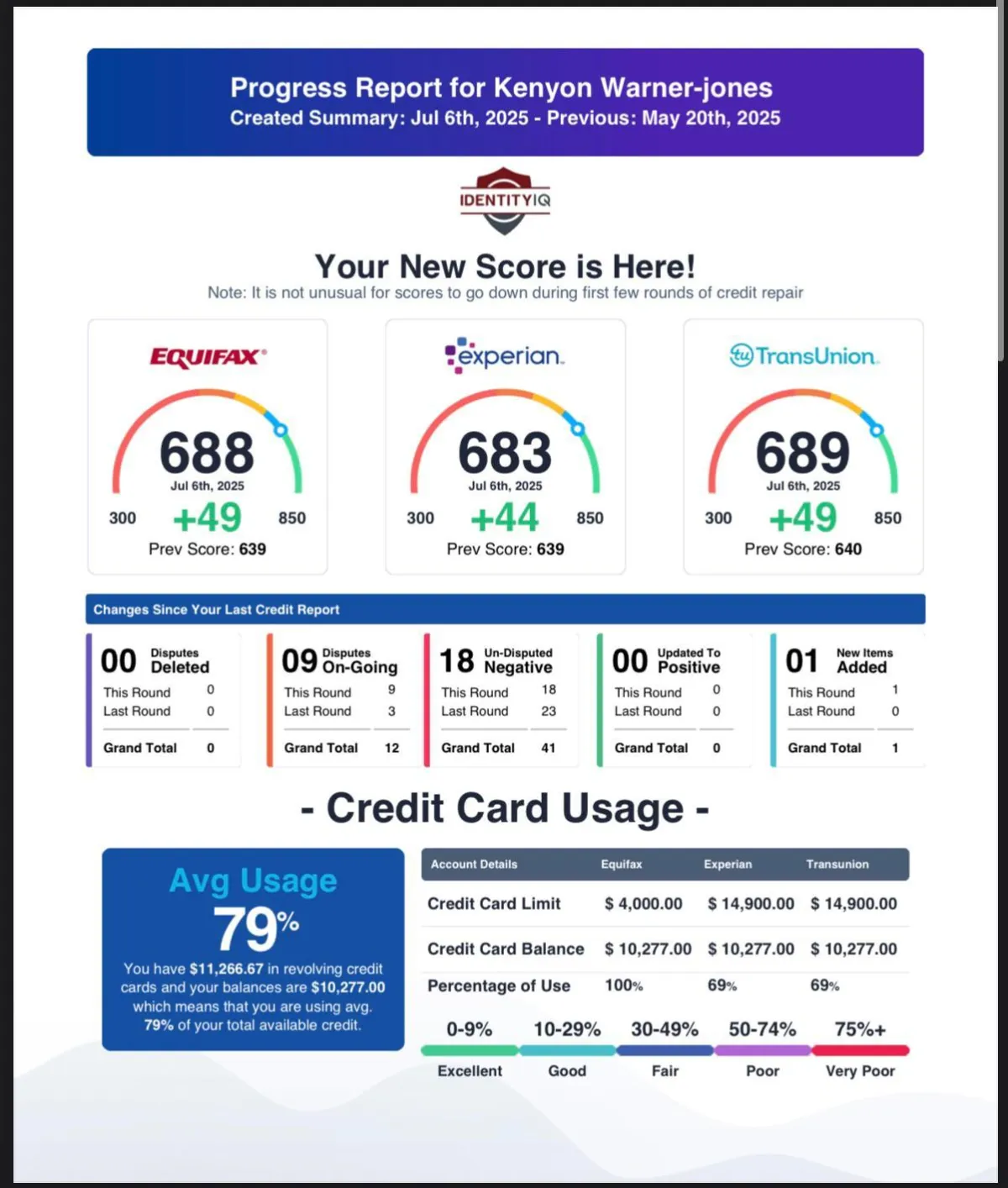

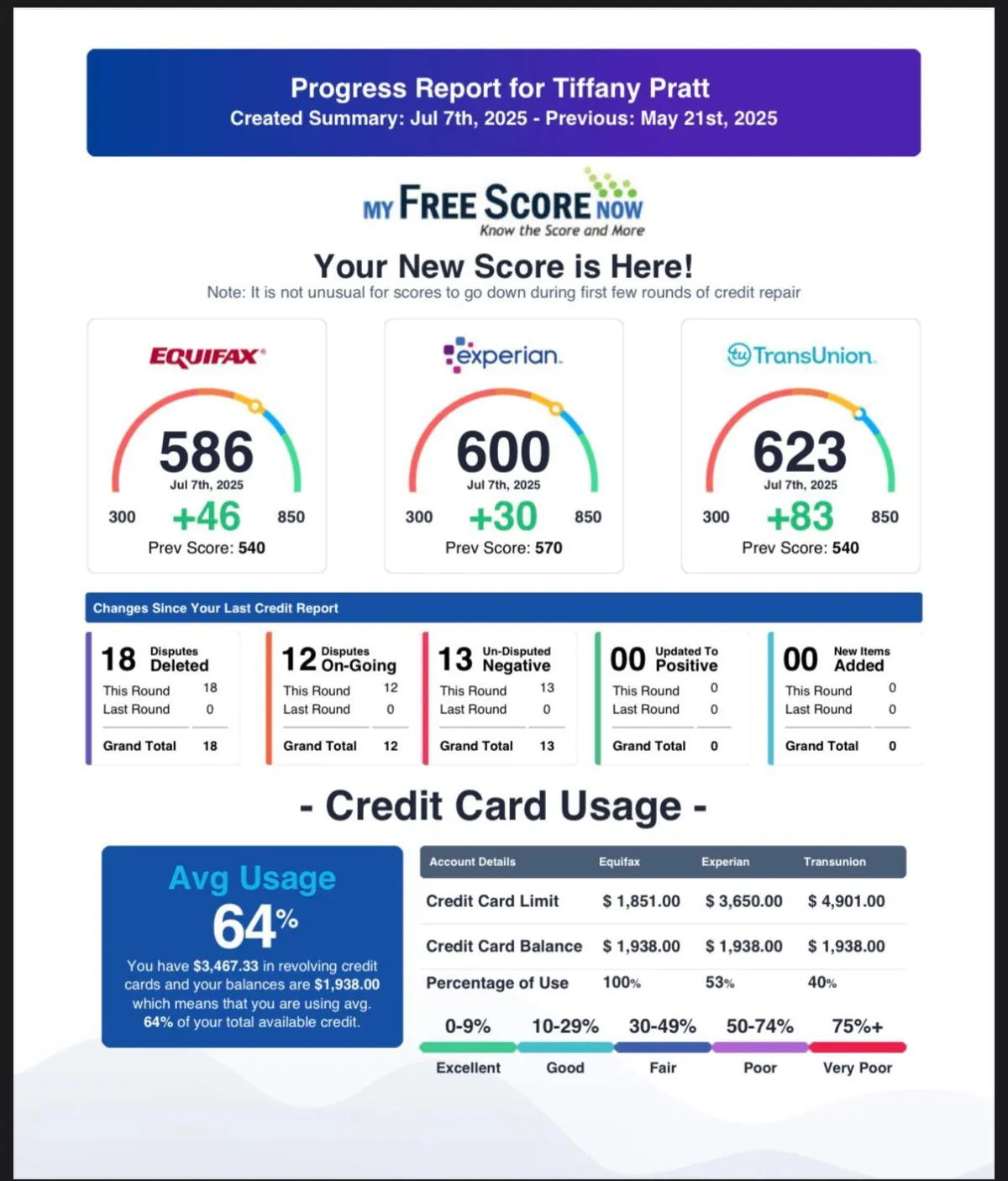

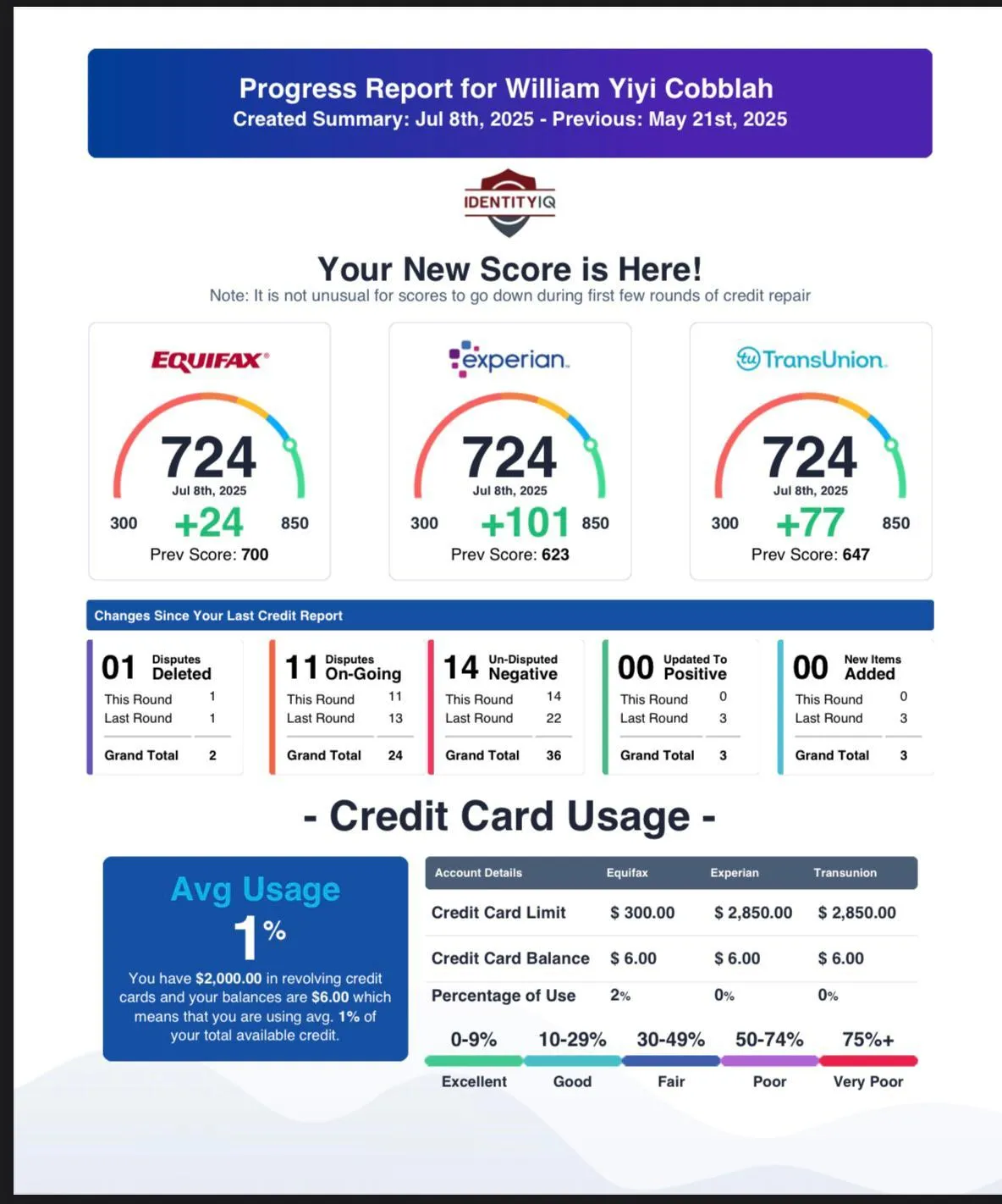

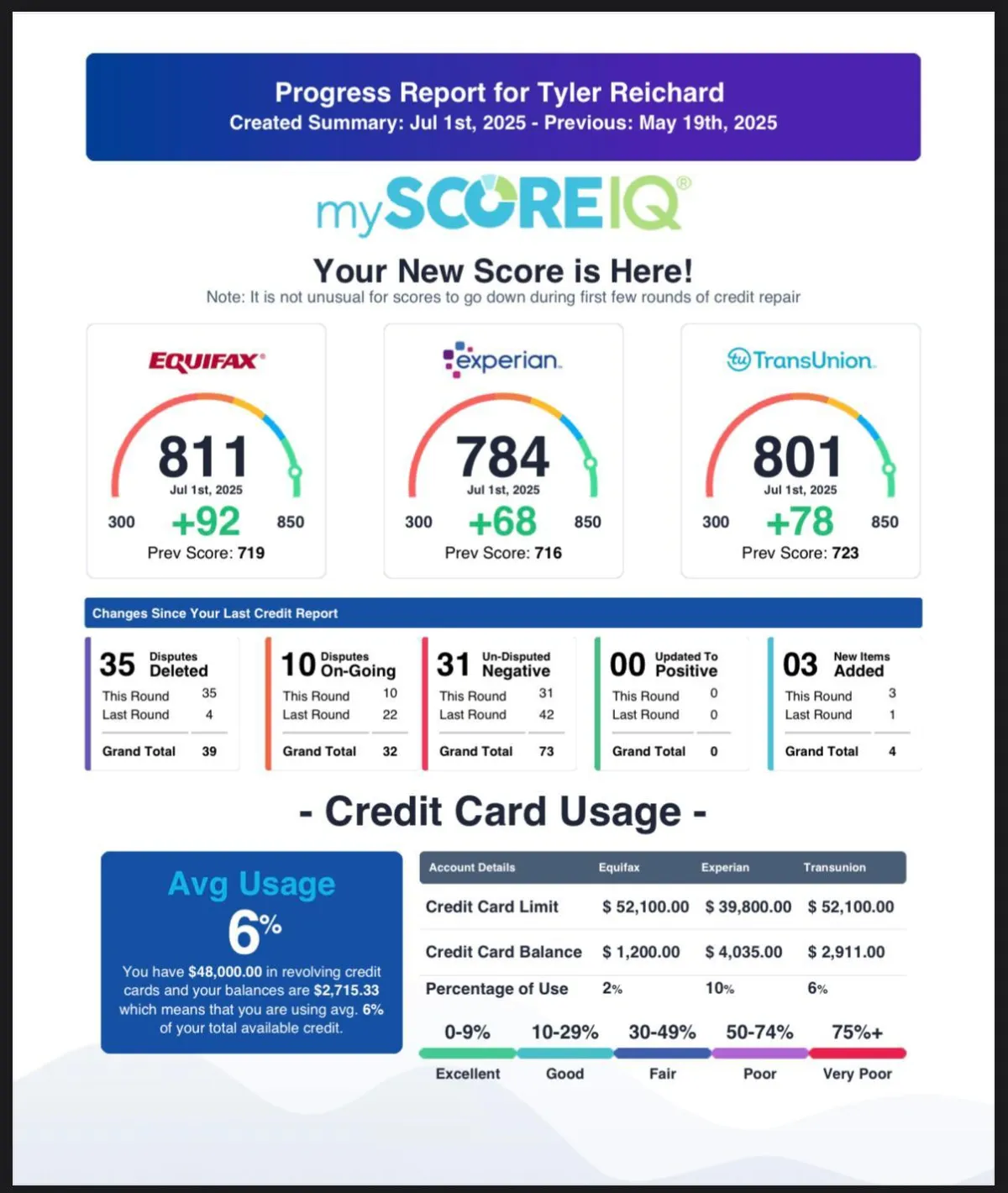

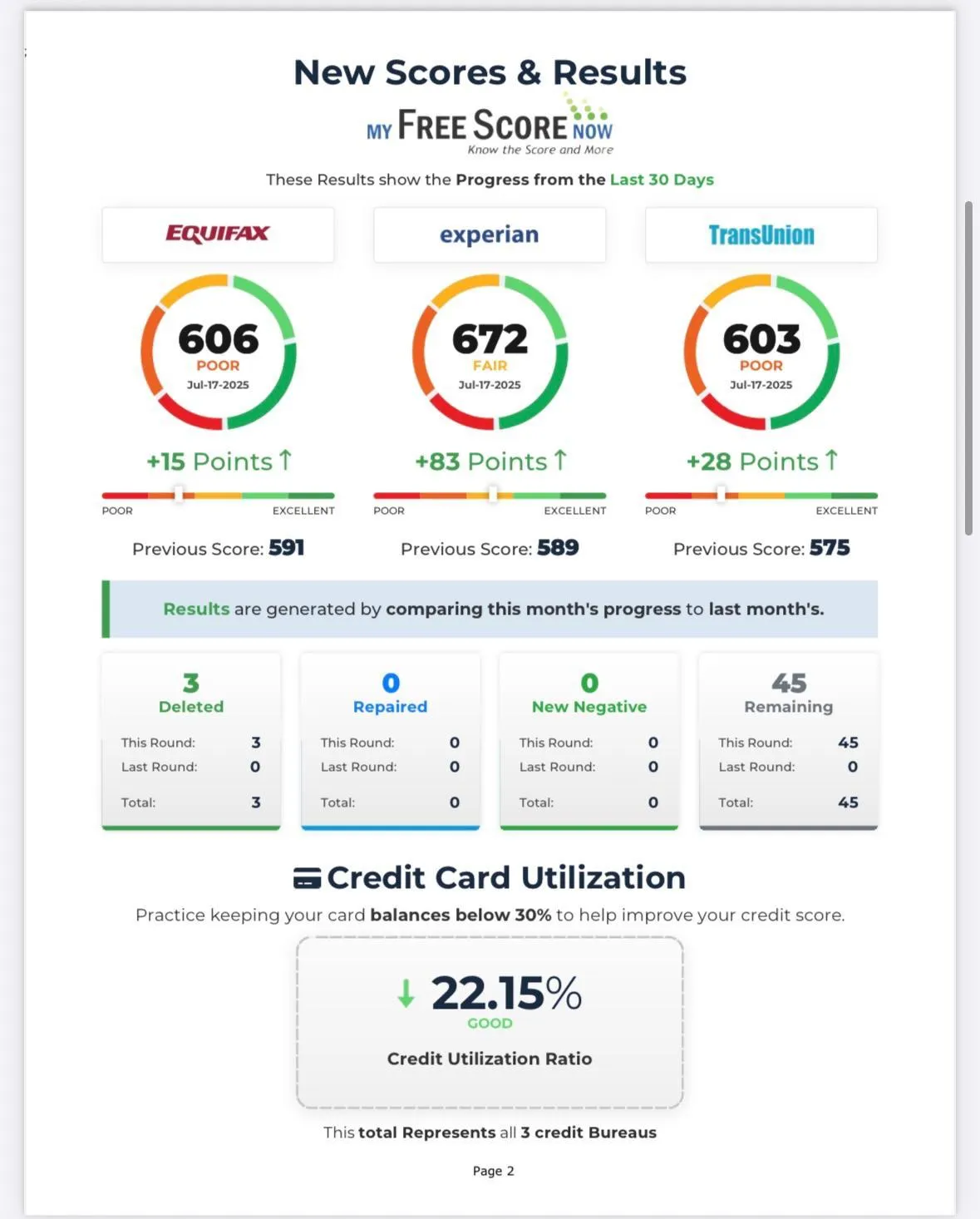

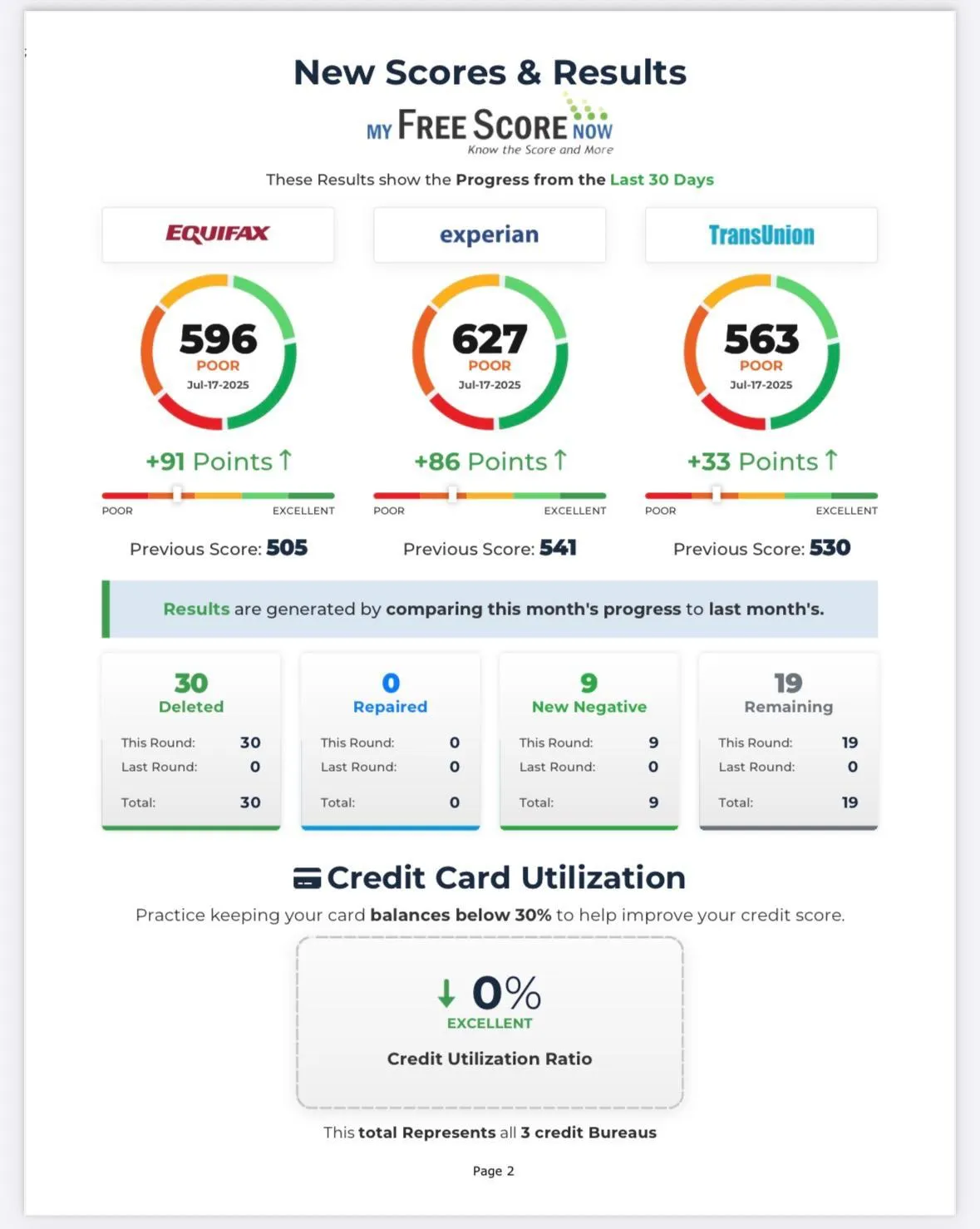

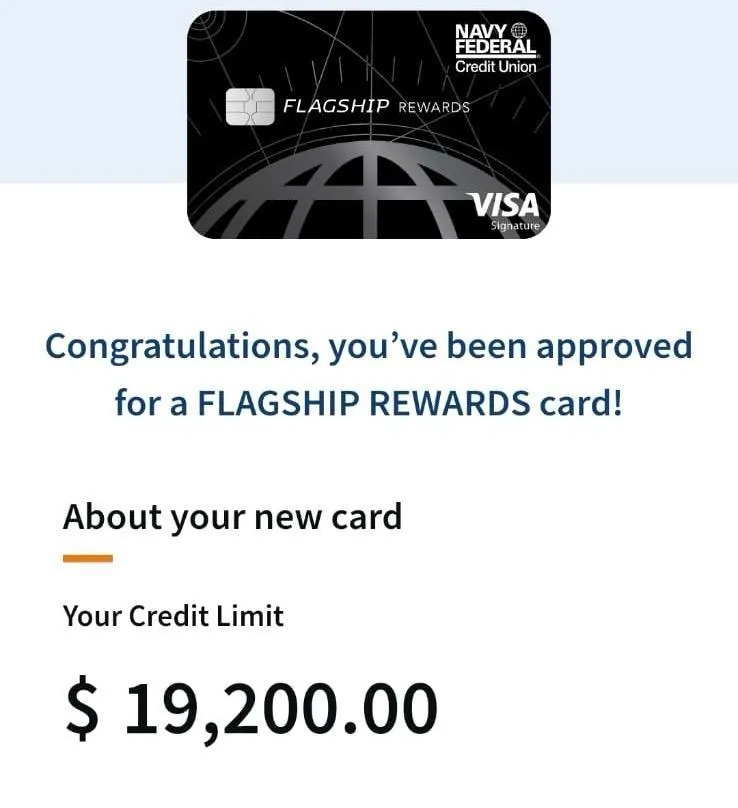

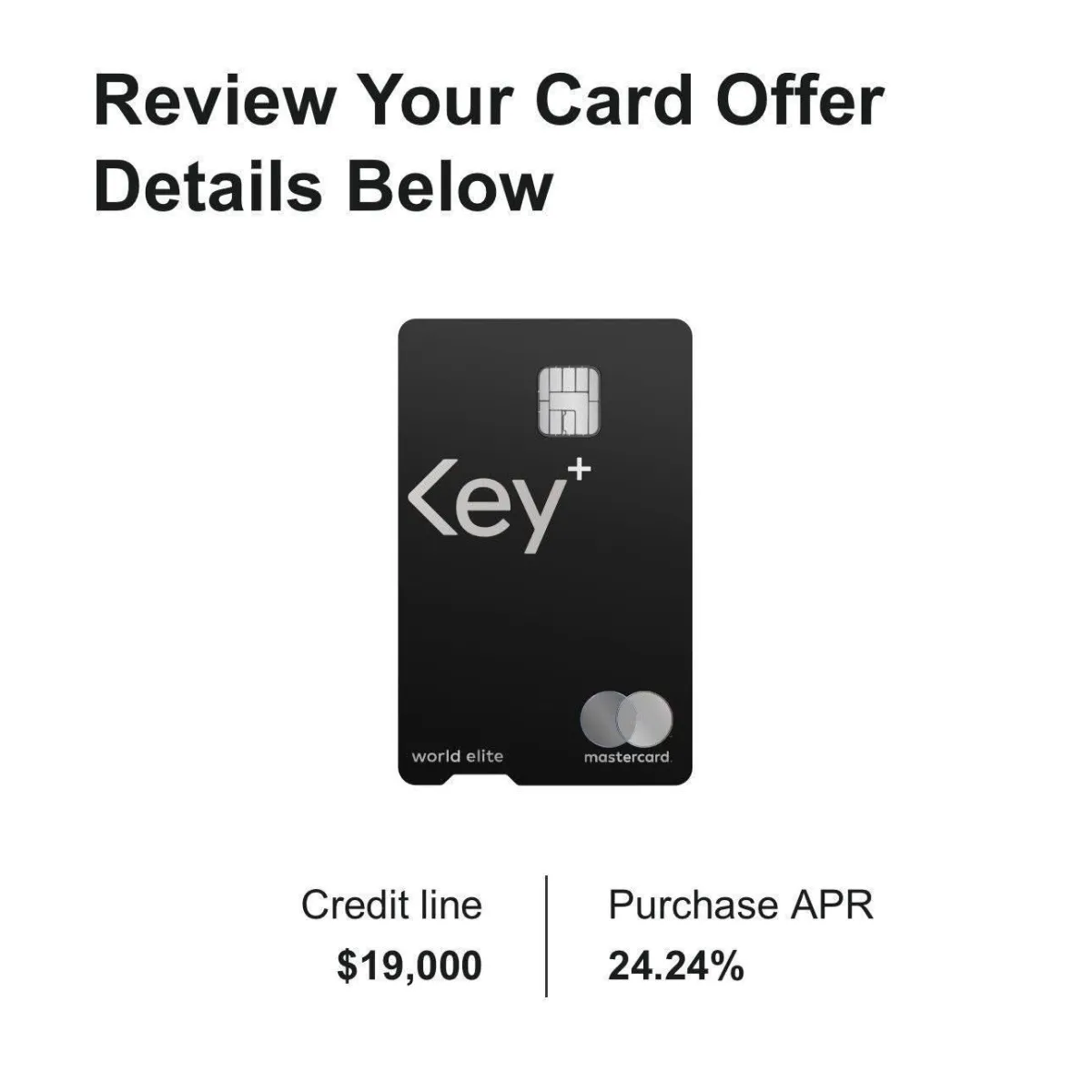

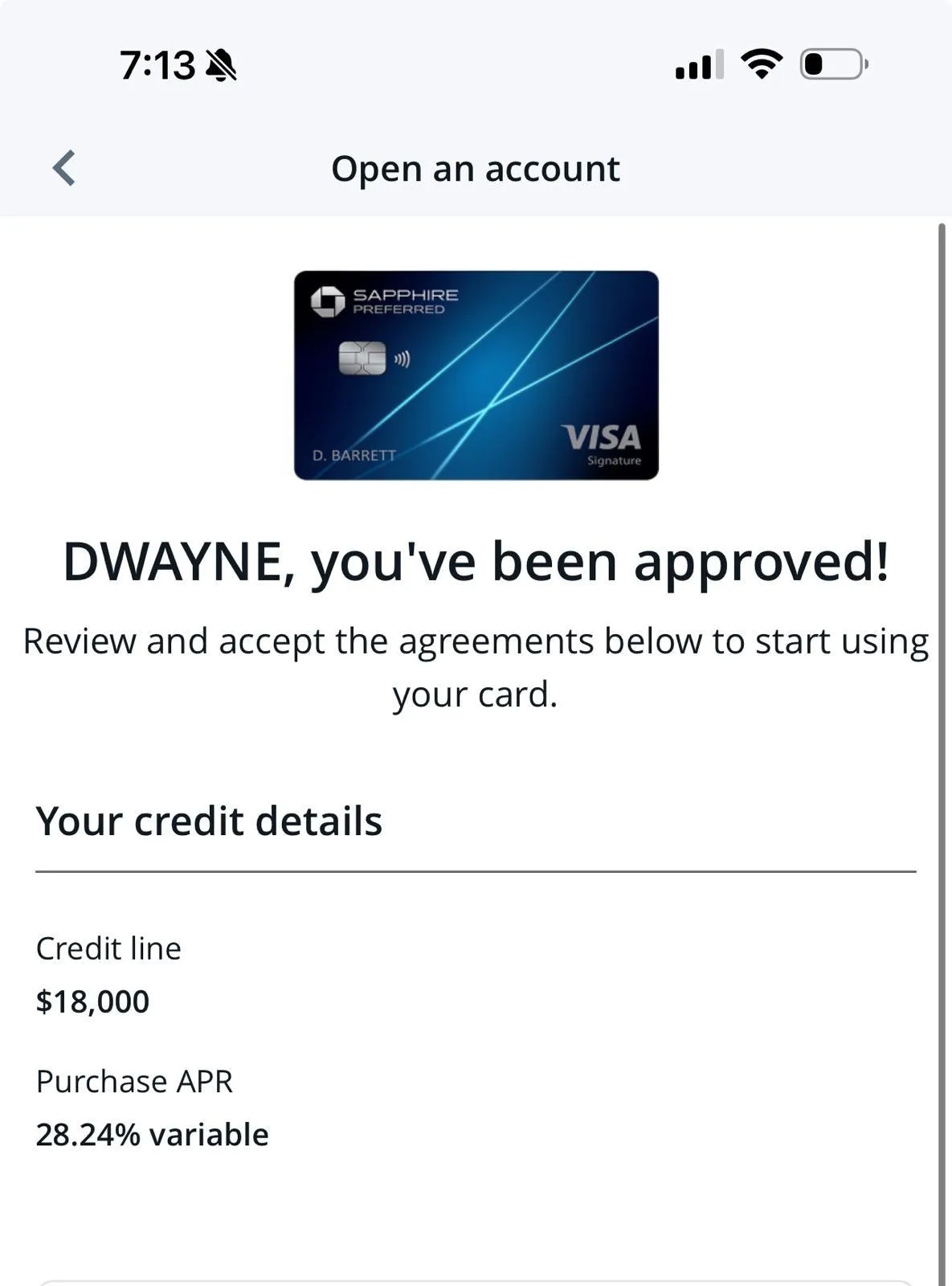

updated client testimonial

updated client testimonial

Client testimonial

Frequently Asked Questions

What is expedited credit repair sweep?

Expedited credit repair is a faster approach to improving your credit by using advanced dispute tactics, legal strategies, and direct communication with credit bureaus and creditors to accelerate the removal of inaccurate or negative items from your report — often within 15 to 45 days, rather than the traditional 3 to 6 months.

How fast can I see results with your service?

Many clients begin seeing initial results within 7 to 14 business days. While results can vary based on your credit profile, our expedited strategies are designed to get faster outcomes compared to standard credit repair methods.

What types of items can you remove from my credit report?

We can challenge and often remove a wide range of negative items, including:

• Collections

• Late Payments

• Charge-Offs

• Bankruptcies

• Repossessions

• Medical Bills

• Inquiries

• Public Records

Each case is reviewed to determine the best strategy for removal. But literally anything !

How does your expedited process work?

Once you sign up, we immediately pull your credit report, identify harmful accounts, and launch aggressive disputes through credit bureaus, creditors, and third-party agencies like the CFPB. We don’t wait 30–45 days between rounds — we apply continuous pressure for quicker results.

Is expedited credit repair legal?

Yes, credit repair — including expedited methods — is 100% legal under the Fair Credit Reporting Act (FCRA). We simply use your rights as a consumer to demand verification, accuracy, and timely removal of any unverifiable or inaccurate information.

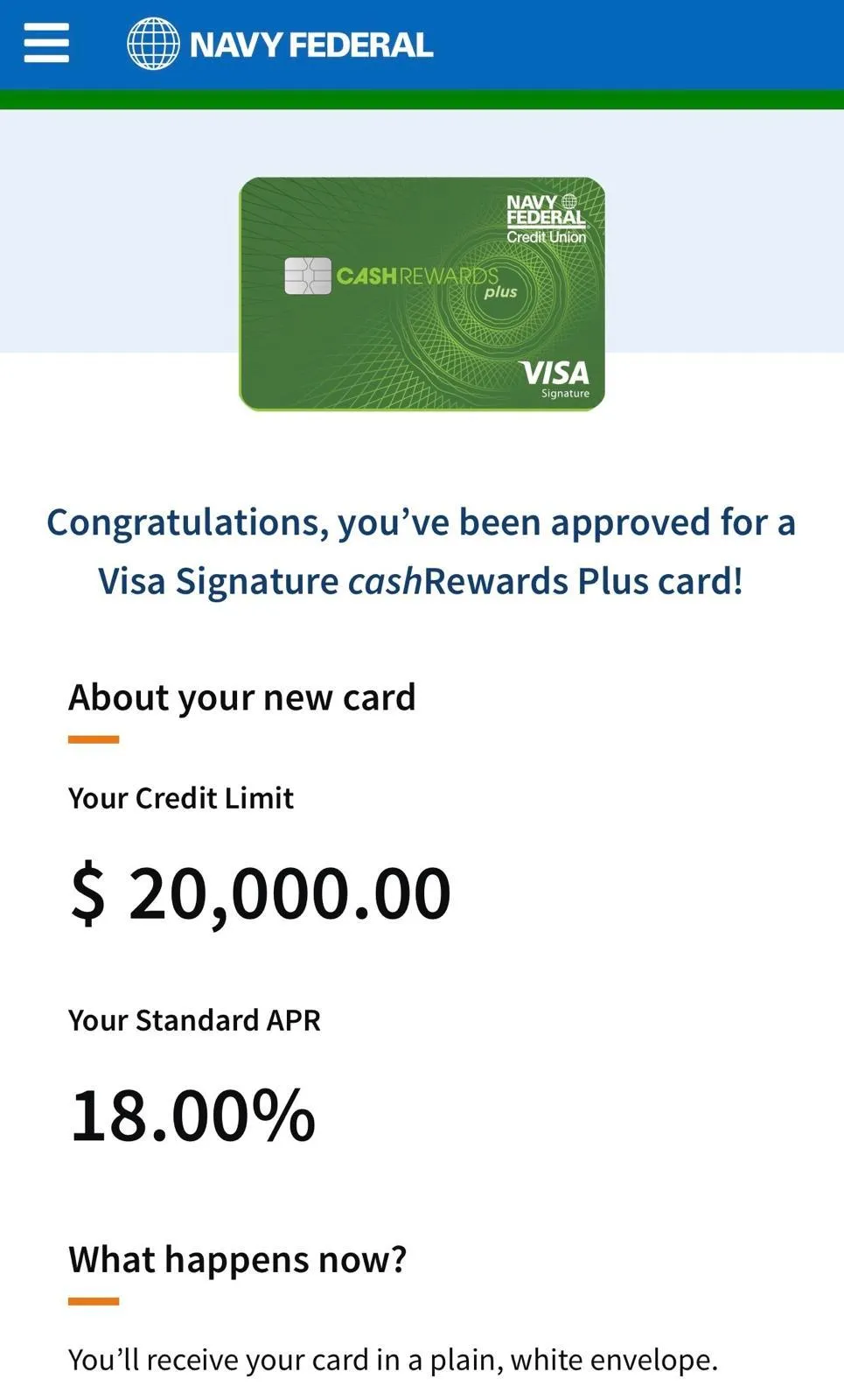

Will your service help me get approved for credit cards, cars, or a home loan?

Absolutely. By increasing your score and cleaning up your report, you’ll improve your chances of being approved for credit cards, auto loans, mortgages, and even business funding. Many of our clients have qualified for major financing within weeks of starting.

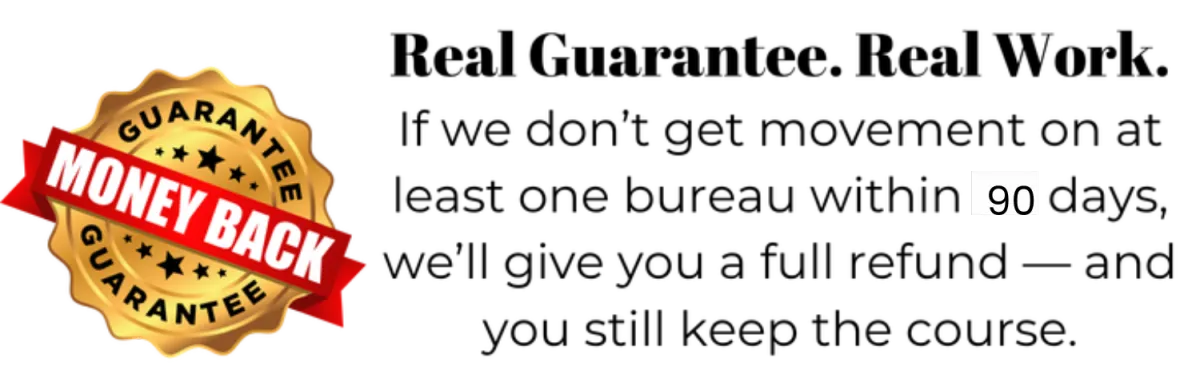

Do you offer a money-back guarantee?

Yes. If we don’t remove any negative items from your report or there no score increase within 90 days, you may be eligible for a partial or full refund — depending on your package and compliance with the process. Your satisfaction is our priority.

What do I need to get started?

To get started, you’ll need:

• A valid government-issued ID

• A recent utility bill or proof of address Social security card

• A signed service agreement. Once we have these, we can begin your expedited repair process immediately.

Why We Need Your ID, Proof of Address, and Social Security Card

To legally dispute items on your credit report, we must verify your identity with the credit bureaus. This protects you from fraud and ensures your personal data is handled correctly. The three required documents are:

• Government-issued ID – Confirms your identity.

• Proof of address (like a utility bill) – Verifies where you currently live.

• Social Security card (or W-2/official document with SSN) – Confirms your Social Security number to match your credit profile.

These documents are required by law and help us file effective disputes on your behalf, ensuring faster and more accurate results.

Will this affect my ability to get new credit while working with you?

Not at all. In fact, cleaning your report and boosting your score may improve your approval odds. We’ll also guide you on which positive tradelines or credit tools to add to further improve your profile.

What Happens If the Credit Bureaus Don’t Cooperate?

We don’t just dispute — we fight back.

If we run into any stubborn or unresponsive accounts, you’re still in a win-win situation. That’s because we have a licensed attorney on our team who will legally pursue the credit bureaus, data furnishers, or creditors if they fail to comply with federal credit laws like the Fair Credit Reporting Act (FCRA).

Here’s how it works:

• If a negative item is inaccurate and the bureaus refuse to delete it,

• Our attorney will file a lawsuit on your behalf,

• And if we win (which we often do), you may receive compensation for each violation — and the negative item still gets removed.

✅ You win if they delete it — your score improves.

✅ You win if they don’t — we sue, get it deleted, and you get paid.

No other credit repair company brings this level of accountability and protection. That’s why our clients don’t just see results — they see justice.

14 day result

Copyrights 2025 | Exquisite Group Worldwide LLC™ | Terms & Conditions